Thursday, August 27, 2009

Financial Banks Mortgage Companies Quotes Augst-27

XLF 14.73 1.03%

FNM 1.92 3.78%

FRE 2.24 10.34%

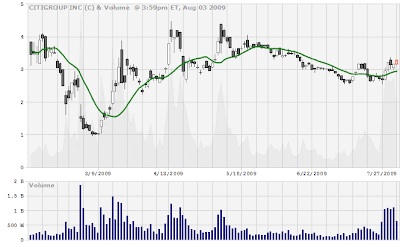

C 5.05 9.07%

BAC 17.92 0.73%

CFNL 7.98 3.50%

FCF 6.33 -0.47%

ETFC 1.45 3.57%

FNM 1.92 3.78%

FRE 2.24 10.34%

C 5.05 9.07%

BAC 17.92 0.73%

CFNL 7.98 3.50%

FCF 6.33 -0.47%

ETFC 1.45 3.57%

Monday, August 24, 2009

Friday, August 21, 2009

Financial and Bank Performance August-21-09

Company Name

Symbol : Market Last

Sale Net

Change %

Change Share

Volume Today's

High/Low 52 Week

High/Low P/E

Ratio Market

Value

(mil.)

Fifth Third Bancorp

FITB : NASDAQ-GS $ 10.909 0.499 4.79% 20,646,310 $ 10.95

$ 10.50 $ 21

$ 1.01 NE 8,288.61

--------------------------------------------------------------------------------

J P Morgan Chase & Co

JPM : NYSE $ 43.66 1.24 2.92% 42,860,923 $ 43.81

$ 42.53 $ 50.63

$ 14.96 50.77 159,463.57

--------------------------------------------------------------------------------

Wells Fargo & Company

WFC : NYSE $ 27.94 0.46 1.67% 51,137,791 $ 28.08

$ 27.62 $ 44.69

$ 7.80 33.66 117,170.87

--------------------------------------------------------------------------------

Bank of America Corporation

BAC : NYSE $ 17.46 0.32 1.87% 236,572,514 $ 17.60

$ 17.31 $ 39.50

$ 2.53 39.68 109,746.84

--------------------------------------------------------------------------------

UBS AG

UBS : NYSE $ 17.54 0.61 3.6% 8,528,916 $ 17.71

$ 17.41 $ 22.61

$ 7.04 N/A 48,600.56

--------------------------------------------------------------------------------

Deutsche Bank AG

DB : NYSE $ 68.93 2.56 3.86% 805,906 $ 69.11

$ 67.97 $ 90

$ 21.13 N/A 41,010.02

--------------------------------------------------------------------------------

Bank of Nova Scotia (The)

BNS : NYSE $ 41.71 0.43 1.04% 409,784 $ 42.17

$ 41.53 $ 48.21

$ 19.24 N/A 40,946.62

--------------------------------------------------------------------------------

U.S. Bancorp

USB : NYSE $ 22.28 0.21 0.95% 16,106,427 $ 22.59

$ 22.21 $ 42.23

$ 8.06 26.84 38,815.90

--------------------------------------------------------------------------------

Bank of New York Mellon Corporation (The)

BK : NYSE $ 29.12 0.18 0.62% 10,470,096 $ 29.21

$ 28.59 $ 9,999

$ 15.44 14.27 34,809.84

--------------------------------------------------------------------------------

State Street Corp

STT : NYSE $ 53.52 0.54 1% 5,288,800 $ 54.74

$ 53.07 $ 73.75

$ 14.43 11.89 26,732.08

--------------------------------------------------------------------------------

Citigroup Inc.

C : NYSE $ 4.70 0.22 4.91% 366,763,415 $ 4.86

$ 4.58 $ 23.50

$ 0.97 NE 24,674.57

--------------------------------------------------------------------------------

PNC Bank Corp.

PNC : NYSE $ 42.86 1.15 2.76% 5,193,676 $ 43

$ 41.38 $ 87.99

$ 16.20 38.61 18,572.59

--------------------------------------------------------------------------------

BB&T Corporation

BBT : NYSE $ 28.03 0.25 0.9% 8,908,270 $ 28.28

$ 27.69 $ 45.31

$ 12.90 15.93 18,005.27

--------------------------------------------------------------------------------

Northern Trust Corporation

NTRS : NASDAQ-GS $ 60.35 0.76 1.24% 2,402,571 $ 61.64

$ 59.77 $ 88.92

$ 33.88 15.01 14,724.76

--------------------------------------------------------------------------------

Capital One Financial Corporation

COF : NYSE $ 36.48 1.44 4.11% 8,893,905 $ 36.58

$ 32.42 $ 63.50

$ 7.80 NE 13,870.79

--------------------------------------------------------------------------------

Itau Unibanco Banco Multiplo SA

ITUB : NYSE $ 18.82 0.06 0.32% 8,415,132 $ 19.23

$ 18.68 $ 19.79

$ 6.70 N/A 12,717.12

--------------------------------------------------------------------------------

SunTrust Banks, Inc.

STI : NYSE $ 22.64 1.18 5.5% 13,465,595 $ 22.95

$ 21.22 $ 64

$ 6 NE 7,657.01

--------------------------------------------------------------------------------

M&T Bank Corporation

MTB : NYSE $ 60.44 0.85 1.43% 885,278 $ 61.15

$ 59.76 $ 108.53

$ 29.11 23.34 7,029.00

--------------------------------------------------------------------------------

Banco Bradesco Sa

BBD : NYSE $ 16.59 0.16 0.97% 6,265,791 $ 16.79

$ 16.49 $ 19.10

$ 7.40 N/A 5,930.97

--------------------------------------------------------------------------------

Comerica Incorporated

CMA : NYSE $ 27.09 0.31 1.16% 3,349,749 $ 27.74

$ 26.95 $ 54

$ 11.72 NE 4,046.83

--------------------------------------------------------------------------------

Regions Financing Tr I

RF : NYSE $ 5.86 0.37 6.74% 52,352,583 $ 5.91

$ 5.59 $ 19.80

$ 2.35 NE 3,815

http://www.nasdaq.com/screening/viewcompetitors.asp?symbol=FITB&symbol=C&symbol=SIRI&symbol=TOL&symbol=BZH&symbol=FNM&selected=FITB

Symbol : Market Last

Sale Net

Change %

Change Share

Volume Today's

High/Low 52 Week

High/Low P/E

Ratio Market

Value

(mil.)

Fifth Third Bancorp

FITB : NASDAQ-GS $ 10.909 0.499 4.79% 20,646,310 $ 10.95

$ 10.50 $ 21

$ 1.01 NE 8,288.61

--------------------------------------------------------------------------------

J P Morgan Chase & Co

JPM : NYSE $ 43.66 1.24 2.92% 42,860,923 $ 43.81

$ 42.53 $ 50.63

$ 14.96 50.77 159,463.57

--------------------------------------------------------------------------------

Wells Fargo & Company

WFC : NYSE $ 27.94 0.46 1.67% 51,137,791 $ 28.08

$ 27.62 $ 44.69

$ 7.80 33.66 117,170.87

--------------------------------------------------------------------------------

Bank of America Corporation

BAC : NYSE $ 17.46 0.32 1.87% 236,572,514 $ 17.60

$ 17.31 $ 39.50

$ 2.53 39.68 109,746.84

--------------------------------------------------------------------------------

UBS AG

UBS : NYSE $ 17.54 0.61 3.6% 8,528,916 $ 17.71

$ 17.41 $ 22.61

$ 7.04 N/A 48,600.56

--------------------------------------------------------------------------------

Deutsche Bank AG

DB : NYSE $ 68.93 2.56 3.86% 805,906 $ 69.11

$ 67.97 $ 90

$ 21.13 N/A 41,010.02

--------------------------------------------------------------------------------

Bank of Nova Scotia (The)

BNS : NYSE $ 41.71 0.43 1.04% 409,784 $ 42.17

$ 41.53 $ 48.21

$ 19.24 N/A 40,946.62

--------------------------------------------------------------------------------

U.S. Bancorp

USB : NYSE $ 22.28 0.21 0.95% 16,106,427 $ 22.59

$ 22.21 $ 42.23

$ 8.06 26.84 38,815.90

--------------------------------------------------------------------------------

Bank of New York Mellon Corporation (The)

BK : NYSE $ 29.12 0.18 0.62% 10,470,096 $ 29.21

$ 28.59 $ 9,999

$ 15.44 14.27 34,809.84

--------------------------------------------------------------------------------

State Street Corp

STT : NYSE $ 53.52 0.54 1% 5,288,800 $ 54.74

$ 53.07 $ 73.75

$ 14.43 11.89 26,732.08

--------------------------------------------------------------------------------

Citigroup Inc.

C : NYSE $ 4.70 0.22 4.91% 366,763,415 $ 4.86

$ 4.58 $ 23.50

$ 0.97 NE 24,674.57

--------------------------------------------------------------------------------

PNC Bank Corp.

PNC : NYSE $ 42.86 1.15 2.76% 5,193,676 $ 43

$ 41.38 $ 87.99

$ 16.20 38.61 18,572.59

--------------------------------------------------------------------------------

BB&T Corporation

BBT : NYSE $ 28.03 0.25 0.9% 8,908,270 $ 28.28

$ 27.69 $ 45.31

$ 12.90 15.93 18,005.27

--------------------------------------------------------------------------------

Northern Trust Corporation

NTRS : NASDAQ-GS $ 60.35 0.76 1.24% 2,402,571 $ 61.64

$ 59.77 $ 88.92

$ 33.88 15.01 14,724.76

--------------------------------------------------------------------------------

Capital One Financial Corporation

COF : NYSE $ 36.48 1.44 4.11% 8,893,905 $ 36.58

$ 32.42 $ 63.50

$ 7.80 NE 13,870.79

--------------------------------------------------------------------------------

Itau Unibanco Banco Multiplo SA

ITUB : NYSE $ 18.82 0.06 0.32% 8,415,132 $ 19.23

$ 18.68 $ 19.79

$ 6.70 N/A 12,717.12

--------------------------------------------------------------------------------

SunTrust Banks, Inc.

STI : NYSE $ 22.64 1.18 5.5% 13,465,595 $ 22.95

$ 21.22 $ 64

$ 6 NE 7,657.01

--------------------------------------------------------------------------------

M&T Bank Corporation

MTB : NYSE $ 60.44 0.85 1.43% 885,278 $ 61.15

$ 59.76 $ 108.53

$ 29.11 23.34 7,029.00

--------------------------------------------------------------------------------

Banco Bradesco Sa

BBD : NYSE $ 16.59 0.16 0.97% 6,265,791 $ 16.79

$ 16.49 $ 19.10

$ 7.40 N/A 5,930.97

--------------------------------------------------------------------------------

Comerica Incorporated

CMA : NYSE $ 27.09 0.31 1.16% 3,349,749 $ 27.74

$ 26.95 $ 54

$ 11.72 NE 4,046.83

--------------------------------------------------------------------------------

Regions Financing Tr I

RF : NYSE $ 5.86 0.37 6.74% 52,352,583 $ 5.91

$ 5.59 $ 19.80

$ 2.35 NE 3,815

http://www.nasdaq.com/screening/viewcompetitors.asp?symbol=FITB&symbol=C&symbol=SIRI&symbol=TOL&symbol=BZH&symbol=FNM&selected=FITB

BANK OF AMERICA "BAC" Close $17.56 August-21-09

Close 17.45 +0.31 (1.81%) 52Wk Range: 2.52 - 38.48

Analyst Ratings

Recommendations Current 1 Month Ago 2 Months Ago 3 Months Ago

Strong Buy 6 5 6 5

Moderate Buy 2 2 2 1

Hold 7 6 7 7

Moderate Sell 1 1 1 1

Strong Sell 1 2 1 3

Mean Rec. 2.35 2.52 2.35 2.76

http://moneycentral.msn.com/investor/invsub/analyst/recomnd.asp?Symbol=BAC

Tuesday, August 18, 2009

Monday, August 17, 2009

CIT Debt Repurchase August-17-09

$1.46 +0.05 (3.55%) 52Wk Range: 0.31 - 12.59

NEW YORK (Aug. 17) - Commercial lender CIT Group Inc. said Monday its offer to repurchase outstanding debt at a discount — a crucial step to help stave off bankruptcy — was successful.

The embattled New York-based lender offered to buy $1 billion in debt that was set to mature Monday. CIT warned that if not enough bondholders were willing to sell the debt back to the company, it would likely have to file for bankruptcy protection.

The company said nearly 60 percent of the debt was tendered for purchase, barely topping the 58 percent minimum needed to complete the offer. CIT is paying $875 for every $1,000 tendered as part of the offer.

CIT will pay off the remaining notes that matured Monday but were not tendered for purchase as part of the offer.

"The completion of this tender offer is another important milestone as the company continues to make progress on the development and execution of a comprehensive restructuring plan," CIT Group said in a statement.

At the same time that CIT received $3 billion in emergency funding last month from its largest bondholders, it launched the offer to buy back outstanding debt in an effort to ease a cash crunch that nearly forced it out of business. CIT turned to and received funding from its bondholders only after negotiations for a government-led bailout failed.

Some experts feared that if CIT collapsed it would deal a crippling blow to an economy still bleeding hundreds of thousands of jobs a month despite a nearly $800 billion federal stimulus program.

The retail sector would be hit especially hard. CIT serves as short-term financier to about 2,000 vendors that supply merchandise to 300,000 stores, according to the National Retail Federation. Analysts say 60 percent of the apparel industry depends on CIT for financing.

http://money.aol.com/article/struggling-cit-group-dodges-bankruptcy/600702

Sunday, August 16, 2009

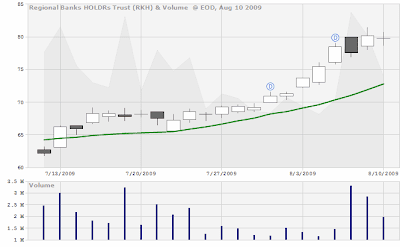

Monday, August 10, 2009

Saturday, August 8, 2009

Wednesday, August 5, 2009

Amer Intl Grp. New (NYSE:AIG) Close $8.48

Tuesday, August 4, 2009

Subscribe to:

Posts (Atom)