Monday, November 9, 2009

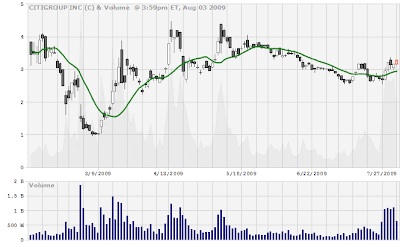

CITI GROUP INC (C) $4.19

Friday, October 30, 2009

Wednesday, September 30, 2009

CIT GROUP INC (CIT) $1.46 Inter-Day

Tuesday, September 29, 2009

Thursday, September 10, 2009

Thursday, August 27, 2009

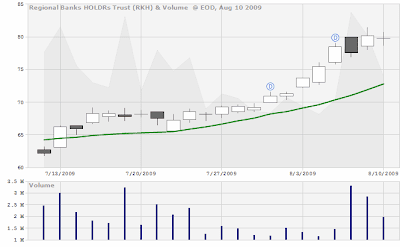

Financial Banks Mortgage Companies Quotes Augst-27

XLF 14.73 1.03%

FNM 1.92 3.78%

FRE 2.24 10.34%

C 5.05 9.07%

BAC 17.92 0.73%

CFNL 7.98 3.50%

FCF 6.33 -0.47%

ETFC 1.45 3.57%

FNM 1.92 3.78%

FRE 2.24 10.34%

C 5.05 9.07%

BAC 17.92 0.73%

CFNL 7.98 3.50%

FCF 6.33 -0.47%

ETFC 1.45 3.57%

Monday, August 24, 2009

Friday, August 21, 2009

Financial and Bank Performance August-21-09

Company Name

Symbol : Market Last

Sale Net

Change %

Change Share

Volume Today's

High/Low 52 Week

High/Low P/E

Ratio Market

Value

(mil.)

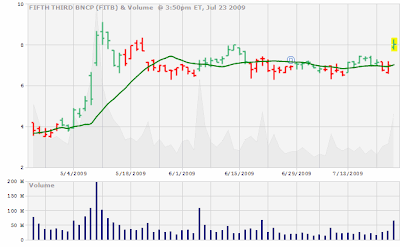

Fifth Third Bancorp

FITB : NASDAQ-GS $ 10.909 0.499 4.79% 20,646,310 $ 10.95

$ 10.50 $ 21

$ 1.01 NE 8,288.61

--------------------------------------------------------------------------------

J P Morgan Chase & Co

JPM : NYSE $ 43.66 1.24 2.92% 42,860,923 $ 43.81

$ 42.53 $ 50.63

$ 14.96 50.77 159,463.57

--------------------------------------------------------------------------------

Wells Fargo & Company

WFC : NYSE $ 27.94 0.46 1.67% 51,137,791 $ 28.08

$ 27.62 $ 44.69

$ 7.80 33.66 117,170.87

--------------------------------------------------------------------------------

Bank of America Corporation

BAC : NYSE $ 17.46 0.32 1.87% 236,572,514 $ 17.60

$ 17.31 $ 39.50

$ 2.53 39.68 109,746.84

--------------------------------------------------------------------------------

UBS AG

UBS : NYSE $ 17.54 0.61 3.6% 8,528,916 $ 17.71

$ 17.41 $ 22.61

$ 7.04 N/A 48,600.56

--------------------------------------------------------------------------------

Deutsche Bank AG

DB : NYSE $ 68.93 2.56 3.86% 805,906 $ 69.11

$ 67.97 $ 90

$ 21.13 N/A 41,010.02

--------------------------------------------------------------------------------

Bank of Nova Scotia (The)

BNS : NYSE $ 41.71 0.43 1.04% 409,784 $ 42.17

$ 41.53 $ 48.21

$ 19.24 N/A 40,946.62

--------------------------------------------------------------------------------

U.S. Bancorp

USB : NYSE $ 22.28 0.21 0.95% 16,106,427 $ 22.59

$ 22.21 $ 42.23

$ 8.06 26.84 38,815.90

--------------------------------------------------------------------------------

Bank of New York Mellon Corporation (The)

BK : NYSE $ 29.12 0.18 0.62% 10,470,096 $ 29.21

$ 28.59 $ 9,999

$ 15.44 14.27 34,809.84

--------------------------------------------------------------------------------

State Street Corp

STT : NYSE $ 53.52 0.54 1% 5,288,800 $ 54.74

$ 53.07 $ 73.75

$ 14.43 11.89 26,732.08

--------------------------------------------------------------------------------

Citigroup Inc.

C : NYSE $ 4.70 0.22 4.91% 366,763,415 $ 4.86

$ 4.58 $ 23.50

$ 0.97 NE 24,674.57

--------------------------------------------------------------------------------

PNC Bank Corp.

PNC : NYSE $ 42.86 1.15 2.76% 5,193,676 $ 43

$ 41.38 $ 87.99

$ 16.20 38.61 18,572.59

--------------------------------------------------------------------------------

BB&T Corporation

BBT : NYSE $ 28.03 0.25 0.9% 8,908,270 $ 28.28

$ 27.69 $ 45.31

$ 12.90 15.93 18,005.27

--------------------------------------------------------------------------------

Northern Trust Corporation

NTRS : NASDAQ-GS $ 60.35 0.76 1.24% 2,402,571 $ 61.64

$ 59.77 $ 88.92

$ 33.88 15.01 14,724.76

--------------------------------------------------------------------------------

Capital One Financial Corporation

COF : NYSE $ 36.48 1.44 4.11% 8,893,905 $ 36.58

$ 32.42 $ 63.50

$ 7.80 NE 13,870.79

--------------------------------------------------------------------------------

Itau Unibanco Banco Multiplo SA

ITUB : NYSE $ 18.82 0.06 0.32% 8,415,132 $ 19.23

$ 18.68 $ 19.79

$ 6.70 N/A 12,717.12

--------------------------------------------------------------------------------

SunTrust Banks, Inc.

STI : NYSE $ 22.64 1.18 5.5% 13,465,595 $ 22.95

$ 21.22 $ 64

$ 6 NE 7,657.01

--------------------------------------------------------------------------------

M&T Bank Corporation

MTB : NYSE $ 60.44 0.85 1.43% 885,278 $ 61.15

$ 59.76 $ 108.53

$ 29.11 23.34 7,029.00

--------------------------------------------------------------------------------

Banco Bradesco Sa

BBD : NYSE $ 16.59 0.16 0.97% 6,265,791 $ 16.79

$ 16.49 $ 19.10

$ 7.40 N/A 5,930.97

--------------------------------------------------------------------------------

Comerica Incorporated

CMA : NYSE $ 27.09 0.31 1.16% 3,349,749 $ 27.74

$ 26.95 $ 54

$ 11.72 NE 4,046.83

--------------------------------------------------------------------------------

Regions Financing Tr I

RF : NYSE $ 5.86 0.37 6.74% 52,352,583 $ 5.91

$ 5.59 $ 19.80

$ 2.35 NE 3,815

http://www.nasdaq.com/screening/viewcompetitors.asp?symbol=FITB&symbol=C&symbol=SIRI&symbol=TOL&symbol=BZH&symbol=FNM&selected=FITB

Symbol : Market Last

Sale Net

Change %

Change Share

Volume Today's

High/Low 52 Week

High/Low P/E

Ratio Market

Value

(mil.)

Fifth Third Bancorp

FITB : NASDAQ-GS $ 10.909 0.499 4.79% 20,646,310 $ 10.95

$ 10.50 $ 21

$ 1.01 NE 8,288.61

--------------------------------------------------------------------------------

J P Morgan Chase & Co

JPM : NYSE $ 43.66 1.24 2.92% 42,860,923 $ 43.81

$ 42.53 $ 50.63

$ 14.96 50.77 159,463.57

--------------------------------------------------------------------------------

Wells Fargo & Company

WFC : NYSE $ 27.94 0.46 1.67% 51,137,791 $ 28.08

$ 27.62 $ 44.69

$ 7.80 33.66 117,170.87

--------------------------------------------------------------------------------

Bank of America Corporation

BAC : NYSE $ 17.46 0.32 1.87% 236,572,514 $ 17.60

$ 17.31 $ 39.50

$ 2.53 39.68 109,746.84

--------------------------------------------------------------------------------

UBS AG

UBS : NYSE $ 17.54 0.61 3.6% 8,528,916 $ 17.71

$ 17.41 $ 22.61

$ 7.04 N/A 48,600.56

--------------------------------------------------------------------------------

Deutsche Bank AG

DB : NYSE $ 68.93 2.56 3.86% 805,906 $ 69.11

$ 67.97 $ 90

$ 21.13 N/A 41,010.02

--------------------------------------------------------------------------------

Bank of Nova Scotia (The)

BNS : NYSE $ 41.71 0.43 1.04% 409,784 $ 42.17

$ 41.53 $ 48.21

$ 19.24 N/A 40,946.62

--------------------------------------------------------------------------------

U.S. Bancorp

USB : NYSE $ 22.28 0.21 0.95% 16,106,427 $ 22.59

$ 22.21 $ 42.23

$ 8.06 26.84 38,815.90

--------------------------------------------------------------------------------

Bank of New York Mellon Corporation (The)

BK : NYSE $ 29.12 0.18 0.62% 10,470,096 $ 29.21

$ 28.59 $ 9,999

$ 15.44 14.27 34,809.84

--------------------------------------------------------------------------------

State Street Corp

STT : NYSE $ 53.52 0.54 1% 5,288,800 $ 54.74

$ 53.07 $ 73.75

$ 14.43 11.89 26,732.08

--------------------------------------------------------------------------------

Citigroup Inc.

C : NYSE $ 4.70 0.22 4.91% 366,763,415 $ 4.86

$ 4.58 $ 23.50

$ 0.97 NE 24,674.57

--------------------------------------------------------------------------------

PNC Bank Corp.

PNC : NYSE $ 42.86 1.15 2.76% 5,193,676 $ 43

$ 41.38 $ 87.99

$ 16.20 38.61 18,572.59

--------------------------------------------------------------------------------

BB&T Corporation

BBT : NYSE $ 28.03 0.25 0.9% 8,908,270 $ 28.28

$ 27.69 $ 45.31

$ 12.90 15.93 18,005.27

--------------------------------------------------------------------------------

Northern Trust Corporation

NTRS : NASDAQ-GS $ 60.35 0.76 1.24% 2,402,571 $ 61.64

$ 59.77 $ 88.92

$ 33.88 15.01 14,724.76

--------------------------------------------------------------------------------

Capital One Financial Corporation

COF : NYSE $ 36.48 1.44 4.11% 8,893,905 $ 36.58

$ 32.42 $ 63.50

$ 7.80 NE 13,870.79

--------------------------------------------------------------------------------

Itau Unibanco Banco Multiplo SA

ITUB : NYSE $ 18.82 0.06 0.32% 8,415,132 $ 19.23

$ 18.68 $ 19.79

$ 6.70 N/A 12,717.12

--------------------------------------------------------------------------------

SunTrust Banks, Inc.

STI : NYSE $ 22.64 1.18 5.5% 13,465,595 $ 22.95

$ 21.22 $ 64

$ 6 NE 7,657.01

--------------------------------------------------------------------------------

M&T Bank Corporation

MTB : NYSE $ 60.44 0.85 1.43% 885,278 $ 61.15

$ 59.76 $ 108.53

$ 29.11 23.34 7,029.00

--------------------------------------------------------------------------------

Banco Bradesco Sa

BBD : NYSE $ 16.59 0.16 0.97% 6,265,791 $ 16.79

$ 16.49 $ 19.10

$ 7.40 N/A 5,930.97

--------------------------------------------------------------------------------

Comerica Incorporated

CMA : NYSE $ 27.09 0.31 1.16% 3,349,749 $ 27.74

$ 26.95 $ 54

$ 11.72 NE 4,046.83

--------------------------------------------------------------------------------

Regions Financing Tr I

RF : NYSE $ 5.86 0.37 6.74% 52,352,583 $ 5.91

$ 5.59 $ 19.80

$ 2.35 NE 3,815

http://www.nasdaq.com/screening/viewcompetitors.asp?symbol=FITB&symbol=C&symbol=SIRI&symbol=TOL&symbol=BZH&symbol=FNM&selected=FITB

BANK OF AMERICA "BAC" Close $17.56 August-21-09

Close 17.45 +0.31 (1.81%) 52Wk Range: 2.52 - 38.48

Analyst Ratings

Recommendations Current 1 Month Ago 2 Months Ago 3 Months Ago

Strong Buy 6 5 6 5

Moderate Buy 2 2 2 1

Hold 7 6 7 7

Moderate Sell 1 1 1 1

Strong Sell 1 2 1 3

Mean Rec. 2.35 2.52 2.35 2.76

http://moneycentral.msn.com/investor/invsub/analyst/recomnd.asp?Symbol=BAC

Tuesday, August 18, 2009

Monday, August 17, 2009

CIT Debt Repurchase August-17-09

$1.46 +0.05 (3.55%) 52Wk Range: 0.31 - 12.59

NEW YORK (Aug. 17) - Commercial lender CIT Group Inc. said Monday its offer to repurchase outstanding debt at a discount — a crucial step to help stave off bankruptcy — was successful.

The embattled New York-based lender offered to buy $1 billion in debt that was set to mature Monday. CIT warned that if not enough bondholders were willing to sell the debt back to the company, it would likely have to file for bankruptcy protection.

The company said nearly 60 percent of the debt was tendered for purchase, barely topping the 58 percent minimum needed to complete the offer. CIT is paying $875 for every $1,000 tendered as part of the offer.

CIT will pay off the remaining notes that matured Monday but were not tendered for purchase as part of the offer.

"The completion of this tender offer is another important milestone as the company continues to make progress on the development and execution of a comprehensive restructuring plan," CIT Group said in a statement.

At the same time that CIT received $3 billion in emergency funding last month from its largest bondholders, it launched the offer to buy back outstanding debt in an effort to ease a cash crunch that nearly forced it out of business. CIT turned to and received funding from its bondholders only after negotiations for a government-led bailout failed.

Some experts feared that if CIT collapsed it would deal a crippling blow to an economy still bleeding hundreds of thousands of jobs a month despite a nearly $800 billion federal stimulus program.

The retail sector would be hit especially hard. CIT serves as short-term financier to about 2,000 vendors that supply merchandise to 300,000 stores, according to the National Retail Federation. Analysts say 60 percent of the apparel industry depends on CIT for financing.

http://money.aol.com/article/struggling-cit-group-dodges-bankruptcy/600702

Sunday, August 16, 2009

Monday, August 10, 2009

Saturday, August 8, 2009

Wednesday, August 5, 2009

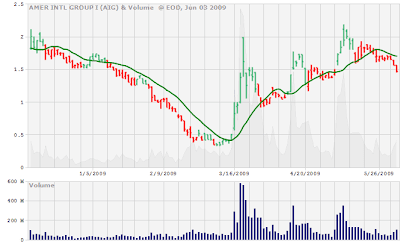

Amer Intl Grp. New (NYSE:AIG) Close $8.48

Tuesday, August 4, 2009

Monday, August 3, 2009

Monday, July 27, 2009

Selected Financial Stocks July-27-09

Symbol : Market Last Sale

Net Change

% Change

52 Week High/Low

P/E

Market Value (mil.)

Bank of America Corporation

BAC : NYSE $ 13.09 0.58 4.64% $ 39.50 $ 2.53 29.75 83,814.82

--------------------------------------------------------------------------------

J P Morgan Chase & Co

JPM : NYSE $ 38.13 0.21 0.55% $ $ 50.63 $ 14.96 44.34 143,336.77

--------------------------------------------------------------------------------

Wells Fargo & Company

WFC : NYSE $ 24.22 0.75 3.2% $ 44.69 $ 7.80 29.18 103,270.69

--------------------------------------------------------------------------------

Deutsche Bank AG

DB : NYSE $ 73.88 0.97 1.33% $ 97.27 $ 21.13 N/A 45,650.45

--------------------------------------------------------------------------------

Bank of Nova Scotia (The)

BNS : NYSE $ 42.56 0.67 1.6% $ 49.22 $ 19.24 N/A 42,216.29

--------------------------------------------------------------------------------

UBS AG

UBS : NYSE $ 14.06 0.16 1.15% $ 22.61 $ 7.04 N/A 40,361.72

--------------------------------------------------------------------------------

U.S. Bancorp

USB : NYSE $ 20.07 0.30 1.52% $ 42.23 $ 8.06 24.18 35,298.37

--------------------------------------------------------------------------------

Bank of New York Mellon Corporation (The)

BK : NYSE $ 27 0.26 0.97% $ $ 9,999 $ 15.44 13.24 31,143.15

--------------------------------------------------------------------------------

State Street Corp

STT : NYSE $ 48.35 0.48 0.98% $ 74.04 $ 14.43 10.74 20,966.16

--------------------------------------------------------------------------------

PNC Bank Corp.

PNC : NYSE $ 34.94 0.77 2.25% $ 87.99 $ 16.20 14.44 15,558.05

--------------------------------------------------------------------------------

Citigroup Inc.

C : NYSE $ 2.69 0.04 1.47% $ 23.50 0.97 NE 14,776.92

--------------------------------------------------------------------------------

Northern Trust Corporation

NTRS : NASDAQ-GS $ 58.15 0.45 0.78%$ 88.92 $ 33.88 14.47 14,011.53

--------------------------------------------------------------------------------

BB&T Corporation

BBT : NYSE $ 21.78 0.76 3.62% $ 45.31 $ 12.90 12.38 12,210.76

--------------------------------------------------------------------------------

Capital One Financial Corporation

COF : NYSE $ 29.82 0.25 0.83% $ 63.50 $ 7.80 NE 11,804.43

--------------------------------------------------------------------------------

M&T Bank Corporation

MTB : NYSE $ 59.53 2.01 3.49% $ 108.53 $ 29.11 22.98 6,614.62

--------------------------------------------------------------------------------

SunTrust Banks, Inc.

STI : NYSE $ 17.95 0.90 5.28% $ 64 $ 6 NE 6,404.63

--------------------------------------------------------------------------------

Banco Bradesco Sa

BBD : NYSE $ 15.99 0.09 0.57% $ 21.65 $ 7.40 N/A 5,883.92

--------------------------------------------------------------------------------

Itau Unibanco Banco Multiplo SA

ITUB : NYSE $ 18.08 0.14 0.78% $ 21.60 $ 6.70 N/A 5,319.05

--------------------------------------------------------------------------------

Fifth Third Bancorp

FITB : NASDAQ-GS $ 8.68 0.1895 2.23% $ 21 $ 1.01 NE 5,007.80

--------------------------------------------------------------------------------

Comerica Incorporated

CMA : NYSE $ 23.39 1.07 4.79% $ 54 $ 11.72 NE 3,534.70

--------------------------------------------------------------------------------

BOK Financial Corporation

BOKF : NASDAQ-GS $ 40.03 2.13 5.62% $ 60.20 $ 22.53 14.14 2,802.26

Net Change

% Change

52 Week High/Low

P/E

Market Value (mil.)

Bank of America Corporation

BAC : NYSE $ 13.09 0.58 4.64% $ 39.50 $ 2.53 29.75 83,814.82

--------------------------------------------------------------------------------

J P Morgan Chase & Co

JPM : NYSE $ 38.13 0.21 0.55% $ $ 50.63 $ 14.96 44.34 143,336.77

--------------------------------------------------------------------------------

Wells Fargo & Company

WFC : NYSE $ 24.22 0.75 3.2% $ 44.69 $ 7.80 29.18 103,270.69

--------------------------------------------------------------------------------

Deutsche Bank AG

DB : NYSE $ 73.88 0.97 1.33% $ 97.27 $ 21.13 N/A 45,650.45

--------------------------------------------------------------------------------

Bank of Nova Scotia (The)

BNS : NYSE $ 42.56 0.67 1.6% $ 49.22 $ 19.24 N/A 42,216.29

--------------------------------------------------------------------------------

UBS AG

UBS : NYSE $ 14.06 0.16 1.15% $ 22.61 $ 7.04 N/A 40,361.72

--------------------------------------------------------------------------------

U.S. Bancorp

USB : NYSE $ 20.07 0.30 1.52% $ 42.23 $ 8.06 24.18 35,298.37

--------------------------------------------------------------------------------

Bank of New York Mellon Corporation (The)

BK : NYSE $ 27 0.26 0.97% $ $ 9,999 $ 15.44 13.24 31,143.15

--------------------------------------------------------------------------------

State Street Corp

STT : NYSE $ 48.35 0.48 0.98% $ 74.04 $ 14.43 10.74 20,966.16

--------------------------------------------------------------------------------

PNC Bank Corp.

PNC : NYSE $ 34.94 0.77 2.25% $ 87.99 $ 16.20 14.44 15,558.05

--------------------------------------------------------------------------------

Citigroup Inc.

C : NYSE $ 2.69 0.04 1.47% $ 23.50 0.97 NE 14,776.92

--------------------------------------------------------------------------------

Northern Trust Corporation

NTRS : NASDAQ-GS $ 58.15 0.45 0.78%$ 88.92 $ 33.88 14.47 14,011.53

--------------------------------------------------------------------------------

BB&T Corporation

BBT : NYSE $ 21.78 0.76 3.62% $ 45.31 $ 12.90 12.38 12,210.76

--------------------------------------------------------------------------------

Capital One Financial Corporation

COF : NYSE $ 29.82 0.25 0.83% $ 63.50 $ 7.80 NE 11,804.43

--------------------------------------------------------------------------------

M&T Bank Corporation

MTB : NYSE $ 59.53 2.01 3.49% $ 108.53 $ 29.11 22.98 6,614.62

--------------------------------------------------------------------------------

SunTrust Banks, Inc.

STI : NYSE $ 17.95 0.90 5.28% $ 64 $ 6 NE 6,404.63

--------------------------------------------------------------------------------

Banco Bradesco Sa

BBD : NYSE $ 15.99 0.09 0.57% $ 21.65 $ 7.40 N/A 5,883.92

--------------------------------------------------------------------------------

Itau Unibanco Banco Multiplo SA

ITUB : NYSE $ 18.08 0.14 0.78% $ 21.60 $ 6.70 N/A 5,319.05

--------------------------------------------------------------------------------

Fifth Third Bancorp

FITB : NASDAQ-GS $ 8.68 0.1895 2.23% $ 21 $ 1.01 NE 5,007.80

--------------------------------------------------------------------------------

Comerica Incorporated

CMA : NYSE $ 23.39 1.07 4.79% $ 54 $ 11.72 NE 3,534.70

--------------------------------------------------------------------------------

BOK Financial Corporation

BOKF : NASDAQ-GS $ 40.03 2.13 5.62% $ 60.20 $ 22.53 14.14 2,802.26

"KEY" KEYCORP July-27-09 Close: $5.55

Saturday, July 25, 2009

Thursday, July 23, 2009

Bank of America Corporation (NYSE: BAC) July-23-09 Close: $12.69

Last Trade $12.69 Change 0.46 ( 3.76%)

Related PRNewswire Releases

7/23 - 12:15 PM Bank of America and National Park Foundation Convene 200+ Student Leaders for Service Learning Project to Preserve Rock Creek Park

7/23 - 12:05 PM Bank of America Announces Foreclosure Relief Program Notifications Will Begin for Countrywide Borrowers

7/23 - 8:05 AM Neil Cotty Returns as Chief Accounting Officer at Bank of America

7/21 - 4:05 PM Bank of America Names Martin Richards San Francisco Market President

7/21 - 11:25 AM Bank of America Declares Quarterly Dividends

7/21 - 9:05 AM 2008 Olympic Marathon Gold Medalist Sammy Wanjiru Selects 2009 Bank of America Chicago Marathon for U.S. Debut

http://financial.townnews.com/detailed/?a=detailed&ticker=bac

Saturday, July 18, 2009

Citigroup Second Quarter Earnings July-17-09

Citigroup Reports Second Quarter Net Income of $4.3 Billion, $0.49 Diluted EPS

Tuesday, July 14, 2009

Monday, June 29, 2009

Saturday, June 27, 2009

Friday, June 19, 2009

Sunday, June 14, 2009

Monday, June 8, 2009

Thursday, June 4, 2009

Wednesday, June 3, 2009

Tuesday, June 2, 2009

Stocks Companies E-K

Category: Companies E-K

E*TRADE (ETFC)

East West Bancorp (EWBC)

Eastman Kodak (EK)

Eaton Corp (ETN)eBay (EBAY)

Electronic Arts (ERTS)

EMC Corp (EMC)

EOG Resources (EOG)

Estee Lauder (EL)

Expedia Inc (EXPE)

Exxon Mobil (XOM)

EZCORP (EZPW)

Family Dollar Stores (FDO)

Federal Natl Mtge (FNM)

FedEx Corp (FDX)

Ford Motor (F)

Fortune Brands (FO)

Freep't McMoRan Copper (FCX)

Gannett Co (GCI)

Gap Inc (GPS)

Garmin Ltd (GRMN)

Genentech Inc (DNA)

General Dynamics Corp (GD)

General Electric (GE)

General Mills (GIS)

Gilead Sciences (GILD)

Goldcorp Inc (GG)

Goldman Sachs Group (GS)

Goodyear Tire and Rubber (GT)

Google (GOOG)

Gramercy Capital (GKK)

H and R Block (HRB)

Halliburton (HAL)

Hansen Natural (HANS)

Harley-Davidson (HOG)

Harrah's Entertainment (HET)

Hasbro Inc (HAS)

Hershey Co (HSY)

Hewlett-Packard (HPQ)

Home Depot (HD)

Honeywell Intl (HON)

Hormel Foods (HRL)

Huaneng Power Intl ADS (HNP)

Hunt(J.B.) Transport (JBHT)

IAC/InterActiveCorp (IACI)

ImClone Systems (IMCL)

Intel (INTC)

International Business Machines (IBM)

Intuit Inc (INTU)

Intuitive Surgical Inc (ISRG)

iRobot Corp. (IRBT)

JetBlue Airways (JBLU)

Johnson and Johnson (JNJ)

Johnson Controls (JCI)

Jones Apparel Group (JNY)

Jones Soda (JSDA)

JPMorgan Chase (JPM)

Juniper Networks (JNPR)

KB HOME (KBH)

Kellogg Co (K)

Kimberly-Clark (KMB)

Kinross Gold (KGC)

KKR Financial (KFN)

Kohl's Corp (KSS)

Kraft Foods'A' (KFT)

Krispy Kreme Doughnuts (KKD)

Kroger Co (KR)

E*TRADE (ETFC)

East West Bancorp (EWBC)

Eastman Kodak (EK)

Eaton Corp (ETN)eBay (EBAY)

Electronic Arts (ERTS)

EMC Corp (EMC)

EOG Resources (EOG)

Estee Lauder (EL)

Expedia Inc (EXPE)

Exxon Mobil (XOM)

EZCORP (EZPW)

Family Dollar Stores (FDO)

Federal Natl Mtge (FNM)

FedEx Corp (FDX)

Ford Motor (F)

Fortune Brands (FO)

Freep't McMoRan Copper (FCX)

Gannett Co (GCI)

Gap Inc (GPS)

Garmin Ltd (GRMN)

Genentech Inc (DNA)

General Dynamics Corp (GD)

General Electric (GE)

General Mills (GIS)

Gilead Sciences (GILD)

Goldcorp Inc (GG)

Goldman Sachs Group (GS)

Goodyear Tire and Rubber (GT)

Google (GOOG)

Gramercy Capital (GKK)

H and R Block (HRB)

Halliburton (HAL)

Hansen Natural (HANS)

Harley-Davidson (HOG)

Harrah's Entertainment (HET)

Hasbro Inc (HAS)

Hershey Co (HSY)

Hewlett-Packard (HPQ)

Home Depot (HD)

Honeywell Intl (HON)

Hormel Foods (HRL)

Huaneng Power Intl ADS (HNP)

Hunt(J.B.) Transport (JBHT)

IAC/InterActiveCorp (IACI)

ImClone Systems (IMCL)

Intel (INTC)

International Business Machines (IBM)

Intuit Inc (INTU)

Intuitive Surgical Inc (ISRG)

iRobot Corp. (IRBT)

JetBlue Airways (JBLU)

Johnson and Johnson (JNJ)

Johnson Controls (JCI)

Jones Apparel Group (JNY)

Jones Soda (JSDA)

JPMorgan Chase (JPM)

Juniper Networks (JNPR)

KB HOME (KBH)

Kellogg Co (K)

Kimberly-Clark (KMB)

Kinross Gold (KGC)

KKR Financial (KFN)

Kohl's Corp (KSS)

Kraft Foods'A' (KFT)

Krispy Kreme Doughnuts (KKD)

Kroger Co (KR)

Monday, June 1, 2009

Saturday, May 30, 2009

Subscribe to:

Posts (Atom)